WASHINGTON (AP) -- The Federal Reserve acknowledged that the economy is growing more slowly than it expected. But it plans to complete its $600 billion Treasury bond buying program by the end of the month.

WASHINGTON (AP) -- The Federal Reserve acknowledged that the economy is growing more slowly than it expected. But it plans to complete its $600 billion Treasury bond buying program by the end of the month.

Concluding a two-day meeting, the Fed repeated a pledge to keep interest rates at record lows for "an extended period." But it believes the main causes of the slowdown, such as high gas prices, are temporary and announced no new efforts to stimulate the economy.

As expected, the central bank said it would keep its massive holdings of Treasury bonds at current levels, an action designed to keep consumer and business loan rates at low levels.

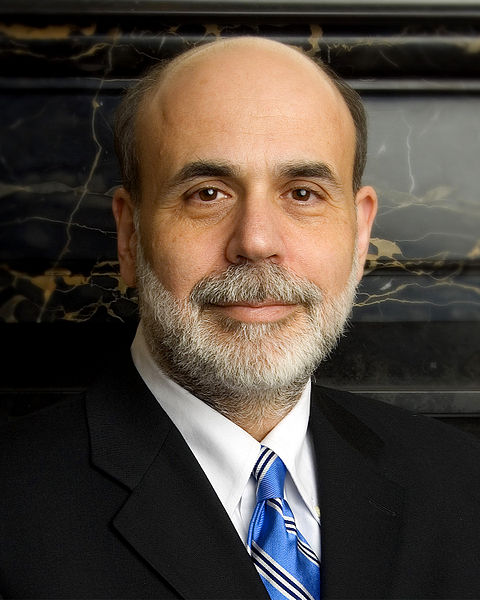

Bernanke and his colleagues are trying to keep a fragile economy on track two years after the Great Recession officially ended.

A sharp spike in gasoline prices earlier this year has made consumers and businesses more cautious about spending. Unemployment is rising again and employers pulled back on hiring in May. Economic growth slowed to 1.8 percent in the first three months of the year. It is not expected to be much higher in the current quarter.

Bernanke has maintained that the slowdown is temporary. He predicts the economy should pick up later this year as the impact of high gas prices and supply disruptions caused by the March earthquake and tsunami in Japan abate. However, the Fed is now confronting renewed jitters that a debt crisis in Greece could spread to other heavily indebted European nations and send shockwaves through U.S. and global financial markets.

The Fed has kept rates at ultra-low levels since December 2008. When the Fed decides to abandon the "extended period" language, it would be viewed as a signal that the Fed was getting ready to reverse course and start boosting interest rates. Many private economists believe it will be another full year before the economy has recovered enough for the Fed to actually start raising interest rates.

The Fed is also winding down its bond-buying program, dubbed QE2, a short-hand for "quantitative easing." It's a wonky term economists use to characterize the Fed's effort to drive down long-term interest rates by buying up Treasury bonds. QE2 marked the second round of such easing the Fed had taken; the first was in March 2009 at the depths of the recession.

Supporters say the bond purchases have worked, in part by keeping rates low and encouraging spending. Low long-term rates are vital for consumers buying homes and cars and for companies making investments.

They also argue that those lower rates fueled a stock rally. When Bernanke outlined plans for QE2 in late August 2010, the Standard & Poor's 500 index was down 6 percent for the year. Eight months later, the S&P 500 was up 28 percent. Lower rates made stocks more attractive to investors than bonds, whose yields were falling.

Falling bond yields have also helped keep mortgage rates near record lows. The average rate on a 30-year mortgage has stayed below 5 percent for all but two weeks this year and was 4.50 percent last week. Still, low rates have done little to boost home sales, which fell in May to the lowest level in since November.

Mark Zandi, chief economist at Moody's Analytics, said the bond purchases gave a sagging economy a lift by slightly reducing borrowing costs for businesses and consumers and by raising stock prices to make people feel wealthier. Still, it didn't much energize home buying or other major purchases.

"It wasn't a slam-dunk success, but it was worthwhile," Zandi said.

Critics, including some Fed officials, saw things differently. They warned that by pumping so much money into the economy, the Fed increased the risks of high inflation later. They have complained that the Fed's outpouring of dollars hurt the dollar and contributed to a spike in oil and food prices. They also feared the bond purchases fed speculative buying that could inflate bubbles in prices of stocks or other assets.

Bernanke hit back at those critics in a speech last month. He argued that higher oil prices were due to Middle East turmoil and demand in fast-growing countries like China and blamed food-price inflation mainly on crop shortages caused by bad weather. And he said the falling dollar was largely linked to slower U.S. growth and the U.S. trade deficit.

© 2011 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed. Learn more about our Privacy Policy and Terms of Use.

- Home

- News

- Opinion

- Entertainment

- Classified

- About Us

MLK Breakfast

MLK Breakfast- Community

- Foundation

- Obituaries

- Donate

11-19-2024 9:50 am • PDX and SEA Weather